Personal Checking

Checking accounts that check all the boxes.

With a DuTrac checking account, you’ll pay no monthly fee and have 24/7 online access to your account. And with overdraft protection and a free debit card, managing your money has never been easier.

Learn more about each of our three types of checking accounts: EcoPlus, Relationship, and High Yield, and the features and benefits you’ll enjoy with a DuTrac checking account.

Account Types

EcoPlus Checking is the perfect account for the tech-savvy member, and for those with other DuTrac deposit accounts or loans.

- Requires a share savings account, subscribing to e-Statements and having a recurring direct deposit

- No minimum balance requirements or monthly maintenance fees

- Receive a .25% lower loan rate on all future secured consumer loans (excludes mortgages, shared-secured loans, CD-secured loans and courtesy pay loans)

- Receive a .25% higher deposit rate on future CDs

- Earn up to $100 for setting up your Bill Pay (ACH electronic payments for various bills including: gas, electric, phone, cable, etc.) within the first 90 days of opening your account. We’ll add $10 to your account for each ACH account you set up for automatic payment.*

- Receive a rebate on ATM surcharges ($10 per statement cycle, member initiated, 60-day limit from the time of the charge)

- Free Mastercard debit card with unlimited transactions

- Automatic alerts when your balance is low

- Overdraft protection

- Free early fraud detection that actively monitors your DuTrac credit card and debit card

- Free identity theft resolution services (assistance with filing a police report or fraud victim affidavit, and handling all documentation and phone calls to resolve the case

- Electronic promotion and rate alerts

- One free annual credit report

*Terms and conditions may apply. Automatic payment bonus will be deposited into members account 90 days after account opening.

®EcoPlus is a registered trademark of DuTrac Community Credit Union.

Relationship Checking is our most basic checking account, with a low minimum opening requirement, and overdraft protection.

- Minimum opening requirement: $25

- 12 free PIN transactions per month; $1.50 plus tax thereafter

- Dividends paid on average daily balances over $1,000

- Check writing limit: 40 per month free; $0.10 plus tax thereafter

- Free Mastercard debit card

For more information, please contact DuTrac at 563-582-1331.

Our High Yield Checking is ideal for those who want to grow their money while keeping it accessible. Dividends are paid on balances over $2,500.

- Minimum Opening Requirement: $2,500

- PIN Transactions: 12 per month free; $1.50 plus tax thereafter

- Dividends paid on average daily balances over $2,500

- Check writing limit: 20 per month free; $0.10 plus tax thereafter

- Free Mastercard debit card

For more information, please contact DuTrac at 563-582-1331.

Account Features

Securely access, monitor and pay bills on-time, accurately and on the dates when you want bills paid through DuTrac’s Bill Pay. Bill Pay is a digital bill-paying solution, at no cost to members, only requiring a subscription to e-Banking or use of the DuTrac app. An introduction and instructions for setting up Bill Pay reside with these two banking resource portals. Please contact a financial services representative for more information or if you have any questions.

Just Tap & Go™

Just Tap & Go™

A faster, safer way to make everyday purchases. It’s like having exact change wherever you go, but even faster and more convenient than cash. Use anywhere you see the Contactless symbol at checkout.

Contactless checkout is ideal when speed and convenience are essential. You can use it at stadiums, fast food restaurants, gas stations, grocery stores, transit locations, and more.

To set up a direct deposit you will need to provide your employer with DuTrac’s routing number and your account number. DuTrac’s routing number is 273974549.

For direct deposit to your savings account you will need your account number; for checking you will need your checking account number which can be found on the bottom of your checks and is the second group of numbers following the routing number shown above.

Our e-Statements are an easy, convenient and secure way to electronically receive your statement. And the best part, they are free—and help to protect the environment.

DuTrac will send you a monthly email letting you know when your e-Statement is available. You must log into e-Banking to view the actual statement. You’ll be able to view e-Statements for 14 months. If you are in need of a statement that is older than 14 months, contact us.

To enroll in e-Statements, you must also enroll in e-Banking—DuTrac’s online banking solution. Simply click on “Electronic Doucments/eStatements Enrollment” and use the toggle to indicate your choice.

DuTrac now offers real-time fraud alerts for Mastercard debit cards. With Text Alert, you can help prevent fraudulent transactions from occurring on your cards.

If a suspicious transaction(s) is identified on your debit card account, a text message will be sent to your mobile device. Reply to confirm whether or not you recognize the transaction(s). If you do not recognize the transaction(s), a block will be placed on your debit card. If you reply, recognizing the transaction(s), your card will remain available for use.

To receive mobile alerts, please call (563) 582-1331 or stop into any DuTrac office location.

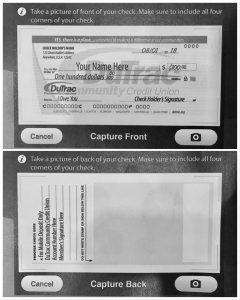

Make a deposit anywhere, anytime using Mobile Deposit through the DuTrac app.

To download the DuTrac app, visit Google Play or the Apple App Store.

- Open the DuTrac app

- Click on the Deposit

- Read endorsement requirements

- Click “Take Photos”, it will have you take a photo of the front and back of your check

- Once photo is accepted use the drop down to “Select” which account you would like to deposit the check into

- Enter the amount of the check

- Click Continue

- The submitted check will show pending on the app until the check is approved by DuTrac staff

Tips for using Mobile Deposit:

- Before logging into the DuTrac app make sure all other apps running in the background on your phone are closed

- When prompted for the amount carefully enter the check amount to ensure it matches the amount written on your check

- Flatten folded or crumpled check before taking your photos

- Keep the check within the viewfinder on the camera screen when capturing your photos. (Try not to get too much of the areas surrounding the check.)

- Take the photos in a well-lit area

- Place the check on a solid dark background before taking the photo

- Keep your phone flat and steady above the check when taking your photos

- Hold the camera as square to the check as possible to reduce corner-to-corner skew

- Make sure that the entire check image is visible and in focus before submitting your deposit

- No shadows across the check

- All four corners must be visible

- The check is not blurry

- The MICR link (numbers on the bottom of your check) is readable

What types of checks can I deposit with Mobile Deposit?

Only checks made payable to you and drawn on institutions located in the United States can be processed through Mobile Deposit. We are unable to accept Money Orders or Travelers Checks through Mobile Deposit.

Are there any fees associated with using Mobile Deposit?

No, there are no fees to use this service. However, wireless carrier, text messaging or internet connectivity fees may be charged for online and/or mobile banking.

How will I know if DuTrac received and processed my deposit?

A message is displayed within e-Banking or the DuTrac app when your deposit has been successfully submitted. You will also receive an email, to the email listed on the account, that the deposit was approved. The deposit will post to your account as a “Mobile Deposit.”

Is there a cut-off time to make a deposit?

For a deposit to be credited on the same day, it must be deposited before 3:00 p.m. (CST) on a business day. Deposits after 3:00 p.m. (CST), on a weekend or federally observed holiday, will be deposited the next business day.

When will my deposit post to my account?

Deposits made prior to 3:00 p.m. (CST) Monday through Friday most often will be posted by 5:00 p.m. when nightly processing has occurred. Deposits made on holidays and weekends will be posted by 5:00 p.m. the next business day.

Will my deposit amount be available right away?

The first $300 deposited per day is available immediately after it is posted to the account. Funds deposited greater than $300, have a two-day business hold. Amounts over $5,000 will be held for five business days.

Can I photograph more than one check at a time?

Only one check can be photographed per deposit.

Should I destroy my check after I photograph the deposit?

No. Once the deposit has been approved by DuTrac, mark on the face of the check “electronically deposited on MM/DD/YYYY” and keep the check for at least five business days to ensure it posts to your account. After five business days, securely destroy the check. Do not void the check after submittal in the event the deposit is not approved and needs to be re-submitted.

What if I submit a deposit for the wrong amount? Do I need to re-submit the deposit?

Yes, if you enter the wrong amount the deposit will fail, and you will need to do a new deposit with the correct amount.

What if I submit the same deposit twice in error?

If the same deposit is submitted twice, we will identify it and stop the transaction. You will receive a declined deposit notification for the second deposit received through the Mobile Deposit.

A check I submitted was returned, can I resubmit it?

No. If a check is returned, you may not re-deposit the check through Mobile Deposit. Please visit one of our branch locations to deposit your check.

Why are my check images blurry?

Taking high-quality photos of a check is the best way to make Mobile Deposit quick and easy. Below are hints to keep in mind:

- Use good lighting

- Place check on a dark background with only the check visible and no other objects or edges visible

- Make sure the entire check is inside the photograph frame

- Holding your phone too close to the check can result in a blurry image

To order checks for your DuTrac checking account, we suggest using our preferred check printer, Checks For Less. Orders placed online will use the information currently printed on your checks.

To locate your account, enter your checking account number—the second group of numbers at the bottom of your checks. If your name or address has changed since you last ordered checks, contact us.

If you are unable to place an order online with Checks For Less, contact us or stop by any branch location.

To view / print a copy of our overdraft coverage options, please click here.

We understand that unexpected overdrafts occur from time to time—Overdraft Coverage can help. There are three ways to cover overdrafts:

1. Overdraft Protection link to another DuTrac deposit account. Fee: $5 plus tax per transfer. Overdraft Protection applies to all transactions and may help prevent overdrafts by automatically transferring funds to your checking account from another DuTrac account

2. Overdraft Protection line of credit. Fee: $5 plus tax per transfer plus interest. Overdraft Protection applies to all transactions and may help prevent overdrafts by automatically transferring funds to your checking account from a DuTrac line of credit. Please note that an Overdraft Protection line of credit is subject to credit approval.

3. Courtesy Pay Fee: $30 fee plus tax per item. Courtesy Pay allows you to overdraw your account up to the disclosed limit to pay a transaction. Even if you have overdraft protection, Courtesy Pay is still available as a secondary coverage if the other protection source is exhausted. Courtesy Pay is not a line of credit; it is a discretionary overdraft service that can be withdrawn at any time without prior notice.

What is the difference between Standard Coverage vs Extended Coverage?

To receive standard Overdraft Protection and Courtesy Pay, no action is required on your part.

To receive Extended Coverage, which also covers ATM withdrawals and everyday debit card transactions, your consent is required.

Business accounts automatically have Extended Coverage. To receive Extended Coverage, contact us. You can discontinue Courtesy Pay any time by contacting us.

Transactions covered with Standard Coverage Courtesy Pay:

- Checks*

- ACH – Automatic Debits

- Recurring Debit Card Payments

- Online Bill Pay Items

- Internet Banking Transfers

- Telephone Banking

- Teller Window Transactions

Transactions covered with Extended Coverage (Your consent required on consumer accounts.) *

- Checks*

- ACH – Automatic Debits

- Recurring Debit Card Payments

- Online Bill Pay Items

- Internet Banking Transfers

- Telephone Banking

- Teller Window Transactions

- ATM Withdrawals

- Everyday Debit Card Transactions

*If you choose Extended Coverage on your consumer account, ATM withdrawals and everyday debit card transactions will be included with the transactions listed under Standard Coverage. If you already have Extended Courtesy Pay coverage, it is not necessary to request it again. Business accounts automatically have Extended Coverage.

You can discontinue the Courtesy Pay in its entirety by contacting us at (563) 582.1331 or by sending an e-mail to: members@DuTrac.org

To select Extended Coverage for future transactions, contact us:

Call: (563) 582-1331

Email: members@DuTrac.org

Online: Complete the online consent form

Visit: Stop by any office location

Mail: Complete a printed consent form and mail to us at: P.O. Box 3250, Dubuque, IA 52004-3250

You can discontinue the Courtesy Pay in its entirety by contacting us by phone at (563) 582-1331 or e-mail at members@DuTrac.org.

What Else You Should Know (Effective May 2023)

- A link to another account or line of credit may be less expensive option than an overdraft. A single larger overdraft will result in just one fee, as opposed to multiple smaller overdrafts. Use our mobile, internet, and telephone banking services to track your balance. For financial education resources, please visit www.mymoney.gov.

- The $30 Overdraft Fee plus tax is charged for each item paid, and a $30 Return Draft Fee is charged for each returned item. If multiple items overdraw your account on the same day, each item will be assessed an appropriate Overdraft Fee or a Return Draft Fee of $30. All fees and charges will be included as part of the Courtesy Pay limit amount. Your account may become overdrawn more than the Courtesy Pay limit amount because of a fee.

- Recipients of federal or state benefits payments who do not wish us to deduct the amount overdrawn and the Overdraft Fee from funds that you deposit or that are deposited into your account may call us at (563) 582-1331 to discontinue Courtesy Pay.

- If an item is returned because the Available Balance (as defined below) in your account is not sufficient to cover the item and the item is presented for payment again, DuTrac Community Credit Union (“We”) will charge a Return Draft Fee each time it returns the item because it exceeds the Available Balance in your account. Because we may charge a Return Draft Fee each time an item is presented, we may charge you more than one fee for any given item as a result of a returned item and representment of the item. When we charge a Return Draft Fee, the charge reduces the Available Balance in your account and may put your account into (or further into) overdraft. If, on representment of the item, the Available Balance in your account is sufficient to cover the item we may pay the item, and, if payment causes an overdraft, charge an Overdraft Fee.

- There is no limit on the total Overdraft Fees per day we will charge.

- This describes the posting order for purposes of determining overdrafts. Our general policy is to post items throughout the day and to post ACH credits before debits in the order received. ATM and PIN-based debit card transactions are posted as they are received. Holds for signature-based transactions are placed as the transaction occurs, and signature-based transactions post throughout the day in the order they are received. Paper checks are posted from lowest to highest dollar amount. However, because of the many ways we allow you to access your account, the posting order of individual items may differ from these general policies. Holds on funds (described herein) and the order in which transactions are posted may impact the total amount of Overdraft Fees or Return Draft Fees assessed.

- Courtesy Pay is not a line of credit; it is a discretionary overdraft service that can be withdrawn at any time without prior notice.

- Depositor and each Authorized Signatory will continue to be liable, jointly and severally, for all overdraft and fee amounts, as described in the Membership Guide. The total (negative) balance, including all fees and charges, is due and payable upon demand.

- We may be obligated to pay some debit card transactions that are not authorized through the payment system but which we are required to pay due to the payment system rules, and as a result you may incur fees if such transactions overdraw your account. However, we will not authorize debit card or ATM transactions unless your account’s Available Balance (including Overdraft Coverage Options) is sufficient to cover the transactions and any fee(s).

- Giving us your consent to pay everyday debit card and ATM overdrafts on your consumer account (Extended Coverage) may result in you incurring Overdraft Fees for transactions that we would otherwise be required to pay without assessing an Overdraft Fee. However, this would allow us to authorize transactions up to the amount of your Courtesy Pay limit. If you consent to Extended Coverage on your consumer account, it will remain on your account until it is otherwise withdrawn.

Understanding your Available Balance

Your account has two kinds of balances: the Actual Balance and the Available Balance.

- We authorize and pay transactions using the Available Balance.

- Your Actual Balance reflects the full amount of all deposits to your account as well as payment transactions that have been posted to your account. It does not reflect checks you have written and are still outstanding or transactions that have been authorized but are still pending.

- Your Available Balance is the amount available to you to use for purchases, withdrawals, or to cover transactions. The Available Balance is your Actual, less any holds due to pending debit card transactions and holds on deposited funds.

- The balance used for authorizing checks, ACH items, and recurring debit card transactions is your Available Balance plus the amount of the Courtesy Pay limit and any available Overdraft Protection.

- The balance used for authorizing ATM and everyday debit card transactions on accounts with Standard Coverage is your Available Balance plus any available Overdraft Protection but does NOT include the Courtesy Pay limit.

- The balance used for authorizing ATM and everyday debit card transactions on accounts with Extended Coverage is your Available Balance plus any available Overdraft Protection and includes the Courtesy Pay limit.

- Because your Available Balance reflects pending transactions and debit holds, your balance may appear to cover a transaction but later upon settlement it may not be sufficient to cover such transaction. In such cases, the transaction may further overdraw your account and be subject to additional overdraft fees. You should assume that any item which would overdraw your account based on your Available Balance may create an overdraft. Note that we may place a hold on deposited funds in accordance with our Membership Guide, which will reduce the amount in your Available Balance.

- Please be aware that the Courtesy Pay amount is not included in your Available Balance provided through online banking, mobile banking or DuTrac Community Credit Union’s regular account statements.

- We will place a hold on your account for any authorized debit card transaction until the transaction settles (usually within two business days) or as permitted by payment system rules. In some cases, the hold may exceed the amount of the transaction. When the hold ends, the funds will be added to the Available Balance in your account. If your account is overdrawn after the held funds are added to the Available Balance and the transaction is posted to the Available Balance, an Overdraft Fee may be assessed.

- Except as described herein, we will not pay items if the Available Balance in your account (including the Courtesy Pay limit, if applicable) is not sufficient to cover the item(s) and the amount of any fee(s).

Understanding Overdraft Privilege Limits

- Eligible consumer and business checking accounts will receive a $100 introductory Courtesy Pay limit at account opening.

- Courtesy Pay limits of up to $500 or $750 with Direct Deposit are available for eligible consumer checking accounts opened at least 35 days in good standing and up to $1000 for eligible business checking accounts opened at least 60 days in good standing.

- Courtesy Pay may be reduced if you default on any loan or other obligation to us, your account becomes subject to any legal or administrative order or levy, or if you fail to maintain your account in good standing by not bringing your account to a positive balance within thirty-two (32) days for a minimum of one business day. You must bring your account balance positive for at least one business day to have the full Courtesy Pay limit reinstated.

If you have any questions about overdraft protection or Courtesy Pay, contact us or visit any branch location.

Additional terms and conditions effective March 1, 2021:

Please review information added to the DuTrac Membership Guide: Section 14 Membership and Account Agreement

- NSF (non-sufficient funds) Fee: $30.00 per item

- Overdraft Fee: $30.00 + tax per item

- Stop Payment Fee: $30.00 + tax per request

- Automatic Overdraft Transfer: $5.00 + tax per transfer or advance

- Automatic Loan Advance: $5.00 + tax per transfer or advance

- Check Fee (Relationship Checking): $.10 each + tax (After first 40 per month at no charge.)

- Check Fee (High Yield Checking): $.10 each + tax (After first 20 per month at no charge.)

- Check Copy: $2.00 + tax per check

- Check Printing Fee: Prices vary depending on style