Frequently Asked Questions

Find the answers you’re looking for with just a click.

Here’s a roundup of the questions we hear most often. If you don’t see the answers you need, contact us or stop by any of our locations. We’re always happy to help.

What is AccessLine?

AccessLine allows you to access your account 24 hours a day by phone. Benefits include:

- Check your current and available account balances

- Find out if a check has cleared

- Transfer money within your accounts

- Make loan payments

How do I enroll in AccessLine?

Contact us or stop by any of our locations to enroll.

What number do I need to call for AccessLine?

If you are currently enrolled in AccessLine, call (563) 557-5000 to access your accounts. Have the following information ready:

- Your member number

- Your PIN number

- Specific account and suffix numbers you would like to access.

Use this chart for prompts and helpful information: AccessLine.

AccessLine is free, however wireless carrier, text messaging or internet connectivity fees may be charged for online and/or mobile banking.

Where can I find DuTrac’s routing number?

DuTrac’s routing number is 273974549. Routing numbers are used for direct deposits, transfers to or from other financial institutions, and domestic wires.

Where can I find my DuTrac account number?

Your 7-digit account number can easily be located at the bottom of your checks next to the routing number, and on your original account documents. If you don’t have checks on hand and need your account number, contact us.

Why does the ATM tell me to insert and remove my card, but then ask me to leave it there? Should I trust this machine?

Yes! With increased skimmer and pin fraud activity in the area, ensuring the safety of your financial information is necessary. Please know that DuTrac is committed to providing the very best service to our members. This two-step measure was put in place to protect you – our member – and your finances. If you have any questions or concerns, please contact a Financial Services Consultant at (56) 582-1331 or email us.

What is GAP coverage and how does it work?

GAP stands for “Guaranteed Auto Protection” and is a great way to protect your finances if the value of your vehicle is less than the amount of your car loan. A good rule of thumb is to assume your new vehicle will depreciate more than 20% after the first year you own it, half of which occurs the minute you drive it off the lot. *

This leaves a gap between what you owe on your loan and the value of your vehicle if it’s deemed a total loss due to an accident or theft. Our GAP program may reduce or eliminate the gap between what your vehicle insurance will pay and what you owe on your loan. Plus, it helps you get into your next vehicle by reducing your loan at the credit union by $1,000.

Our GAP Plus program includes Deductible Assistance which is designed to provide financial relief when your vehicle is damaged but not deemed a total loss. If repairs cost more than your deductible, the deductible amount is applied to your vehicle loan at the credit union, reducing what you owe.

*Car Depreciation: How Much Value Will a New Car Lose? CARFAX, Nov 9, 2018.

Your purchase of MEMBER’S CHOICE™ Guaranteed Asset Protection (GAP), which includes deductible assistance, is optional and will not affect your application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

GAP purchased from state chartered credit unions in FL, GA, IA, RI, UT, VT, and WI, may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee. GAP purchased from state chartered credit unions in CO, MO, or SC may be canceled at any time during the loan and receive a refund of the unearned fee. GAP purchased from state chartered credit unions in IN may be with or without a refund provision. If the credit union offers a refund provision, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP-2488407.1-0419-0521 © CUNA Mutual Group, 2019. All Rights Reserved.

What is Mechanical Repair coverage?

Minimize the disruption of car repairs with mechanical repair coverage. Get a quote today by stopping by any branch location or by calling a DuTrac representative at 563-582-1331.

Do you offer a payment protection program on vehicle loans?

Yes. Our MEMBER’S CHOICE Payment Protection can help if your income is reduced or eliminated due to involuntary unemployment, a disabling injury or illness or an unexpected death.

How do I access Bill Pay?

Bill Pay is a digital bill-paying solution, at no cost to members, only requiring enrollment in e-Banking or use of DuTrac’s app. An introduction and instructions for setting up Bill Pay reside with these two banking resource portals. Please contact a financial services representative for more information or if you have any questions.

What is my checking account number?

Your checking account number, in most cases, is your share savings account number with a “9” added at the end. Your checking account number can be found on the bottom of your checks. It is the middle set of numbers.

How can I get direct deposit of my paycheck?

To have your funds directly deposited into your DuTrac checking account, contact your personnel or payroll department at work. If you have additional questions, contact a highly qualified Financial Services Consultant at members@dutrac.org or call (563) 582-1331.

How do I order checks?

You can open your checking account online or stop in to any DuTrac location. Our preferred check printer is Checks For Less. Orders placed online will use the information currently printed on your checks.

To locate your account, enter your checking account number—the second group of numbers at the bottom of your checks. If your name or address has changed since you last ordered checks, contact us.

If you are unable to place an order online with Checks For Less, contact us at the number above, send us an email or stop by any branch location.

Do you offer overdraft protection?

Yes, it applies to all transactions and may help prevent overdrafts by automatically transferring funds to your checking account from another DuTrac account or a line of credit. There is a $5 fee for each transaction. Please note that an overdraft protection line of credit is subject to credit approval.

Do you offer courtesy pay?

Yes, Courtesy Pay allows you to overdraw your account up to the disclosed limit to pay a transaction. There is a $30 fee plus tax per item. Even if you have overdraft protection, Courtesy Pay is still available as a secondary coverage if the other protection source is exhausted. Courtesy Pay is not a line of credit; it is a discretionary overdraft service that can be withdrawn at any time without prior notice.

What is the difference between Standard Coverage vs Extended Coverage?

To receive standard Overdraft Protection and Courtesy Pay, no action is required on your part.

To receive Extended Coverage, which also covers ATM withdrawals and everyday debit card transactions, your consent is required.

Business accounts automatically have Extended Coverage. To receive Extended Coverage, contact us. You can discontinue Courtesy Pay any time by contacting us.

What else should I know about Overdraft Protection and Courtesy Pay?

- A $30 overdraft fee plus tax is charged for each overdraft item paid, and a $30 return draft fee is charged for each returned item. If multiple items overdraw your account on the same day, each item will be assessed an appropriate overdraft fee or a return draft fee. All fees and charges will be included as part of the Courtesy Pay limit amount. Your account may become overdrawn more than the Courtesy Pay limit amount because of a fee.

- There is no limit on the total overdraft fees per day we may charge.

- Our general policy is to post items throughout the day and to post ACH credits before ACH debits in the order in which they are received. ATM and PIN-based debit card transactions post as they are received. Holds for signature-based transactions are placed as the transaction occurs, and signature-based transactions post throughout the day in the order they are received. Paper checks are posted from lowest to highest dollar amount. However, because of the many ways we allow you to access your account, the posting order of individual items may differ from these general policies. Holds on funds (described herein) and the order in which transactions are posted may impact the total amount of overdraft fees or return draft fees assessed.

- Although under payment system rules, DuTrac may be obligated to pay some unauthorized debit card transactions, DuTrac will not authorize debit card or ATM transactions unless there are available funds (including Overdraft Coverage Options) to cover the transactions and any fee(s).

- Giving DuTrac your consent to pay everyday debit card and ATM overdrafts on your consumer account (Extended Coverage) may result in you incurring overdraft fees for transactions that we would otherwise be required to pay without assessing an overdraft fee. However, this would allow us to authorize transactions up to the amount of your Courtesy Pay limit and may also help you avoid overdrafts in excess of your available balance that could result in suspension of your debit card. If you consent to Extended Coverage on your consumer account, it will remain on your account until you withdraw it.

- DuTrac authorizes and pays transactions using the available balance in your account. DuTrac may place a hold on deposited funds in accordance with our Membership Guide, which will reduce the amount in your available balance. The available balance for checks, ACH items, and recurring debit card transactions is comprised of the ledger balance, less any holds on deposited funds and any debit card holds, plus the amount of the Courtesy Pay limit and any available overdraft protection. The available balance for ATM and everyday debit card transactions on accounts with Standard Coverage is the ledger balance, less any holds on deposited funds and any debit card holds, plus any available overdraft protection, but does NOT include Courtesy Pay. For accounts with Extended Coverage, the Courtesy Pay Limit is included in the available balance for authorizing ATM and everyday debit card transactions.

- Please be aware the Courtesy Pay amount is not included in your available balance provided through online banking, mobile banking or DuTrac Community Credit Union.

- DuTrac will place a hold on your account for any authorized debit card transaction until the transaction settles (usually within two business days) or as permitted by payment system rules. In some cases, the hold may exceed the amount of the transaction. When the hold ends, the funds will be added to the available balance in your account. If your account is overdrawn after the held funds are added to the available balance and the transaction is posted to the available balance, an overdraft fee may be assessed.

- Except as described herein, DuTrac will not pay items if your account does not contain available funds (including the Courtesy Pay limit) to cover the item(s) and the amount of any fee(s).

- DuTrac may suspend your debit card if you incur overdrafts in excess of the available balance in your account, including any Courtesy Pay limit (as described herein). Debit cards on your account will remain suspended until you make sufficient deposits so that your available balance, taking into account any Courtesy Pay limit, is positive and you have contacted us.

- DuTrac may also suspend your debit card if your account is overdrawn more than thirty-two (32) consecutive calendar days. Debit cards on your account will remain suspended until you make sufficient deposits so that your account balance is positive.

- DuTrac may also suspend your debit card if we are unable to contact you due to an incorrect mailing address or phone number(s). You must contact us with your correct mailing address and/or phone number(s) to have your debit card reinstated.

- If your debit card is suspended, you will be unable to use your debit card for purchases or to access your account at the ATM, and if you use your debit card for recurring payments, e.g., utilities, you are responsible for making other arrangements for your recurring debit payment(s).

- Eligible consumer and commercial checking accounts will receive a $100 introductory Courtesy Pay Limit at account opening.

- Courtesy Pay Limits of up to $500 or $750 with direct deposit are available for eligible consumer checking accounts opened at least 35 days and are in good standing and up to $1,000 for eligible commercial checking accounts opened at least 60 days and are in good standing.

- Courtesy Pay may be discontinued if you default on any loan or other obligation to DuTrac, your account becomes subject to any legal or administrative order or levy, or if you fail to maintain your account in good standing by not bringing your account to a positive balance within thirty-two (32) days for a minimum of one business day. You must bring your account balance positive for at least one business day to have Courtesy Pay

- Depositor and each authorized signatory will continue to be liable, jointly and severally, for all overdraft and fee amounts, as described in the Membership Guide. The total (negative) balance, including all fees and charges, is due and payable upon demand.

If you have any questions about Overdraft Protection or Courtesy Pay, contact us or visit any branch location.

What is a Contactless Card?

A contactless card means you do not need to insert your card into the point of sale (POS) card terminal. Instead, simply hold your card within 1-2 inches from POS terminal and your card information will be read and transmitted for payment.

Every contactless transaction generates a unique code, similar to chip transactions. This helps to protect your card against fraud and keeps your information safe.

Contactless transactions only work within 1-2 inches from the terminal.

Do my DuTrac cards have the contactless feature?

Currently, our DuTrac debit cards allow for contactless transactions.

How do I use the contactless feature?

- Look for the contactless symbol on the payment terminal.

- Tap your card to the front of the POS terminal.

- Wait for a beep or green light before removing your card.

- Follow any instructions on the screen (you may be asked to sign or enter your PIN).

How can I report a lost or stolen credit card?

To report a lost or stolen credit card, ATM SecureCard or debit card, call (563) 582-1331.

To report a lost or stolen ATM SecureCard or debit card AFTER REGULAR BUSINESS HOURS call (844) 561-7287.

To report a lost or stolen credit card AFTER REGULAR BUSINESS HOURS call (855) 851-5316.

To report suspicious activity on your account or if you have been a victim of fraud, call (563) 582-1331 or your local police.

What is CardValet®?

CardValet® is a mobile debit/credit card management application helping to reduce fraud by allowing cardholders to monitor credit card accounts with their smartphone and control how, when, and where their debit/credit card is used.

It was developed in partnership with Fiserv and is available in the Apple® App Store or Google® Play. Once set up on your smartphone, CardValet can:

- Allow cardholders the ability to “turn off” their card(s) when not being used.

- Establish transaction spending limits.

- Decline a transaction when a charge exceeds a predefined threshold.

What are uChoose Rewards?

With uChoose Rewards you earn points every time you use your DuTrac Platinum Rewards or Business Platinum Rewards Mastercard – and with some retailers, earn additional points.

You will begin earning points on your DuTrac Platinum Rewards or Business Platinum Rewards Mastercard with your first purchase. To view your points earned, login to PC Branch and click on your credit card. From there, click into “Card Info Access” to retrieve your credit card information. The uChoose Rewards link will be connected through their logo on the left-hand side of the page.

How do I redeem and manage points?

It can take up to 30 business days for your points to be credited to your account and you must accumulate one point before you can start redeeming.

Afterwards, you can redeem for any number of things by simply looking for “Total Points Available for Redemption” on the “Point Details” page on the uChoose Rewards site to see how many points you have available.

You can then visit the “Redeem Points” page to choose from millions of options whether you prefer products, travel experiences, activities, event tickets, gift cards, make a deposit to a checking account or receive cash back.

Points will expire three years from the end of the month in which they were posted and a maximum of 200,000 points per year can be earned.

If you return or cancel an item, points to your account are reversed from that sale.

How do I get cash back?

If you choose cash back when redeeming your points, cash will be given back in the form of a credit on your Mastercard credit card statement. Minimum amount of 2,500 points needed to redeem cash back.

Can I get an alert if there is suspicious activity on my card?

DuTrac now offers real-time fraud alerts for Mastercard debit cards. With Text Alert, you can help prevent fraudulent transactions from occurring on your cards.

To enroll in Text Alerts, please contact us or stop by any branch location.

How do the Mobile Alerts work?

If a suspicious transaction(s) is identified on your debit card account, a text message will be sent to your mobile device. Reply to confirm whether or not you recognize the transaction(s). If you do not recognize the transaction(s), a block will be placed on your debit card. If you reply, recognizing the transaction(s), your card will remain available for use.

To receive mobile alerts, please call (563) 582-1331 or stop into any DuTrac office location.

What is CardValet®?

CardValet® is a mobile debit/credit card management application helping to reduce fraud by allowing cardholders to monitor credit card accounts with their smartphone and control how, when, and where their debit/credit card is used.

It was developed in partnership with Fiserv and is available in the Apple® App Store or Google® Play. Once set up on your smartphone, CardValet can:

- Allow cardholders the ability to “turn off” their card(s) when not being used.

- Establish transaction spending limits.

- Decline a transaction when a charge exceeds a predefined threshold.

How do I set up direct deposit for my paychecks?

To set up a direct deposit you will need to provide your employer with DuTrac’s routing number and your account number. DuTrac’s routing number is 273974549.

For direct deposit to your savings account you will need your account number; for checking you will need your checking account number which can be found on the bottom of your checks and is the second group of numbers following the routing number shown above.

What is the DuTrac app?

The DuTrac app provides DuTrac members with the ability to use their smartphone or compatible mobile device to view their account balance and perform various account functions. To use the DuTrac app, you must first be enrolled in e-Banking.

How do I get the DuTrac app?

Download the app from your smartphone’s app store or log into your e-Banking account to enroll in the Mobile Browser or Text Banking services.

I do not have a smartphone or browser-based mobile device. Can I still access my accounts on the go?

Members without smartphones or browser-enabled mobile devices can still receive account balances and transaction information through Text Banking. After registering your device and enrolling in Text Banking, you can request account balances by texting “BAL” to 59289. You can also receive transaction history by texting “HIST” plus the account code/nickname setup during enrollment, or receive instructions on the go by texting “HELP” to 59289.

Is there a cost for using the DuTrac app?

It is free to members. Standard carrier rates apply to text messages and data transfer.

Can I register more than one account on my phone?

At this time, you can only register one account/user ID per device. If you try to register your phone to a second account, it will delete the original phone registration. When you initially register to use the DuTrac app or texting service, you will be able to indicate which accounts you want to access through mobile services.

Can I do transfers to and from my accounts?

Yes, you can transfer funds to/from the account(s) set up on the registered device. You may also transfer from the account set up on the registered device to any cross-accounts that exist within e-Banking, which you have chosen to include as an account within the DuTrac app.

What if my phone is lost or stolen?

If your phone is lost or stolen, your DuTrac app account information remains secure. The app does not store any personal information on your phone, and a password is required every time you log in to the app to protect your accounts from unauthorized access.

As an added level of security, full account numbers are never displayed on the app. You can log in to e-Banking at any time to deactivate a device and prevent any text- or browser-based banking from that phone.

What do I need to use e-Banking?

You’ll need a computer or mobile device (smartphone or tablet) with access to the internet. DuTrac’s e-Banking is certified to work with the latest versions of Internet Explorer (11 & Edge), Mozilla Firefox, Google Chrome and Safari.

How should my browser be configured?

Before you log in, it is important that you configure your browser to ensure the security of your e-Banking transactions. All default settings for Internet Explorer (11 & Edge), Mozilla Firefox, Google Chrome and Safari will allow for proper viewing.

Due to an issue acknowledged by Microsoft, having Content Advisor enabled can cause problems with secure sites. If you are having problems logging into e-Banking, make sure that your Content Advisor is disabled. Go to Tools—Internet Options. Select the Content tab and click on Disable under Content Advisor.

What should I do if I get locked out of e-Banking?

Use the “Forgot Password” link on the password page of the login process. You will be required to confirm your identity to reset your password.

What should I do if I can sign in, but the system will not show my account balance?

Check your browser configuration. e-Banking requires Java and Cookies be enabled in your browser setup.

When I make a transfer how soon will my new balance appear?

After you make a transfer through e-Banking, a confirmation screen will appear and will show your new balances in the “Available” section. Your new balance becomes effective immediately.

Why can’t I transfer to my spouse’s/children’s account(s)?

Transfer to other accounts is available if you are a joint member on the account you want to transfer to. You must request this access be set up. To request this access, contact us.

Is there a fee for using e-Banking?

There are no fees for using e-Banking, however some of the services performed or requested may have a fee associated with them, such as a stop payment on a check.

Can I use my AccessLine/SecureCard PIN to access my account information online?

No, you must use the password supplied to you specifically for e-Banking. Once logged in, you can then change the password to a code of your choice, if it falls within the password guidelines. To do this, go to the “Other Services” page in e-Banking and select “Change Password.”

Will I get a receipt for my transfers?

All transfers will be confirmed on screen and will appear on your regular statement. In addition, your transaction will appear in the History section in e-Banking.

Why can’t I transfer to my IRA?

IRA transfers require special handling per IRS regulations and currently cannot be made through e-Banking.

When I make a transfer from my savings account(s) I see a message about Reg D, what is that?

Regulation D is a federal regulation that limits the number of transactions done in a savings account online or by telephone, among other things. You are allowed six not in-person transactions a month. There is no limit to the number of in-person transactions.

How do I sign up for e-Statements?

To receive e-Statements, you must enroll in e-Banking. Simply click on “Additional Services” and then “e-Statements” and use the toggle to indicate your choice.

How do I know when my e-Statement is ready?

DuTrac will send you a monthly email letting you know when your e-Statement is available. You must log into e-Banking to view the actual statement.

How long do I have to view an e-Statement?

You are able to view e-Statements for a period of 14 months. If you need a statement that is older than 14 months, contact us.

How is a chip-enhanced card different from a magnetic stripe card?

A chip-enhanced card contains an embedded microchip. The chip holds encrypted information, making it extremely difficult for the card to be copied or counterfeited. Rather than swiping the card, you will insert your card into a chip-enabled terminal to complete a transaction. In addition to the embedded microchip, the chip card has a magnetic stripe on the back, and purchases can still be made by swiping the card with merchants that have not yet switched to chip-enabled terminals.

Where can I use my chip card?

Use your chip card at the exact same merchants you do now, by inserting the card into terminals that are chip-enabled. You can still swipe your card at merchant locations that have not yet switched to chip-enabled terminals. You can also continue to use your cards as you do currently for online and telephone payments.

When should I contact DuTrac during my home-buying search?

Visit us before you even begin to shop for a new home. A basic pre-qualifying exercise will give you an understanding for how much home you can afford. Mortgage pre-approval will take this one step better, and will not only provide you with affordability information, but also will give you a leg-up in the negotiation process. A buyer with guaranteed funds has more leverage in a negotiation than one who is still waiting to hear back from their lender.

What is a first mortgage?

A first mortgage is the first loan on a certain piece of property. No other lien has been taken out on the home. When you first buy a house, the loan you typically receive is a first mortgage.

What is a second mortgage?

A second mortgage is a second loan against a specific piece of property. Consider this example: You have a first mortgage on your home. The value is $100,000 and you have a $60,000 balance left to pay on your loan. The $40,000 difference is considered equity, or the part of the home that you own outright. If you wish to further borrow against that $40,000, you would be taking out a second mortgage on the home. Why borrow against this equity? In many cases, the interest rate you pay on your mortgage is lower than many other types of loans. Interest is also frequently tax deductible for a first or second mortgage, but not necessarily for a car loan or a credit card. (Consult your tax advisor for more information on tax deductibility and home loans.)

What does it mean to ‘sell my mortgage on the secondary market’?

This phrase is not nearly as ominous as it sounds. Frequently, a credit union can offer you an extremely competitive rate on the secondary market. This is simply a network of large mortgage lenders that work with the credit union to deliver low rates to borrowers. If the member chooses, they can finance their home loan with a secondary market lender and can do so through the credit union. The credit union may technically hold the loan for a very short period before ‘selling it’ to this other lender. The member often makes their loan payments to—and receives loan servicing from— this secondary market lender.

What documents do I need for a mortgage loan application?

We recommend having these documents available:

- Previous two years of W-2 forms

- Original pay stubs for the most recent 30-day period

- Most recent bank statements

- Copy of the purchase agreement and earnest check if buying

- If self-employed, two years of tax returns and all schedules

- If a first-time homebuyer in Iowa, three years of tax returns

What is DuTrac’s Member Advantage?

Any DuTrac member, at any time, can move any secured consumer loan(s) with another lender to DuTrac and receive an interest rate discount of up to or more than 1% less interest than you’re currently paying. If DuTrac’s standard rate is even lower, you’ll receive the lower rate.

Membership in DuTrac Community Credit Union is a condition of this offer. To qualify for membership, certain eligibility requirements must be met. Loan approval is subject to DuTrac’s normal underwriting guidelines and some restrictions apply. Borrower’s credit score must be 640 or higher at the time of the loan application.

Member’s Choice Payment Protection can help your family keep its standard of living if your income is reduced or eliminated due to involuntary unemployment, a disabling injury or illness or an unexpected death.

Member’s Choice Payment Protection is available for:

- Auto & Motor Vehicle Loans

- Personal Loans

- Home Equity Lines of Credit

- Credit Cards

Our claims process is quick and easy. If you elected payment protection on your loan, you can use this convenient claims process to quickly and easily file your claim for any of the following Payment Protection Products:

- Life

- Disability

- Involuntary unemployment

To begin, please fill out a claim form at https://myclaimportal.cunamutual.com/link/contract?ContractNumber=01401640.

If you prefer, call 1.800.621.6323 to begin the process and a CUNA Mutual Group Claims Specialist will guide you through the process.

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. Payment protection products include debt protection products available through the credit union.

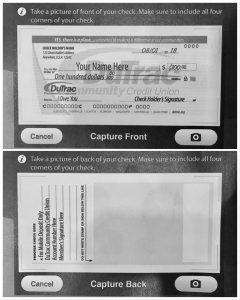

Make a deposit anywhere, anytime using Mobile Deposit through the DuTrac app. The only requirement is enrollment in DuTrac’s e-banking. (If you haven’t yet signed up, you can do so here.

To download the DuTrac app, visit Google Play or the Apple App Store.

- Open the DuTrac app

- Select Mobile Deposit from the main menu on the left

- Select New Deposit

- Select the account to deposit funds into and enter the deposit amount of the check

(Joint owners will need to select the bottom right button with the people icon on the mobile deposit menu) - Take a photo of the front and back of your check and submit the images

- Confirm the deposit amount

- The submitted check will show pending until approved by DuTrac staff

- You MUST sign legibly and endorse all items transmitted through this service with the following: – For Mobile Deposit Only – Credit Union Name: DuTrac Community Credit Union – Member’s Account Number – Member’s Signature

Tips for using Mobile Deposit:

- Before logging into the DuTrac app make sure all other apps running in the background on your phone are closed

- When prompted for the amount carefully enter the check amount to ensure it matches the amount written on your check

- Flatten folded or crumpled check before taking your photos

- Keep the check within the view finder on the camera screen when capturing your photos. (Try not to get too much of the areas surrounding the check.)

- Take the photos in a well-lit area

- Place the check on a solid dark background before taking the photo

- Keep your phone flat and steady above the check when taking your photos

- Hold the camera as square to the check as possible to reduce corner to corner skew

- Make sure that the entire check image is visible and in focus before submitting your deposit

- No shadows across the check

- All four corners must be visible

- The check is not blurry

- The MICR link (numbers on the bottom of your check) is readable

What types of checks can I deposit with Mobile Deposit?

Only checks made payable to you and drawn on institutions located in the United States can be processed through Mobile Deposit. We are unable to accept Money Orders or Travelers Checks through Mobile Deposit.

Are there any fees associated with using Mobile Deposit?

No, there are no fees to use this service. However, wireless carrier, text messaging or internet connectivity fees may be charged for online and/or mobile banking.

How will I know if DuTrac received and processed my deposit?

A message is displayed within e-Banking or DuTrac app when your deposit has been successfully submitted. The deposit will post to your account as a “Mobile Deposit.”

Is there a cut-off time to make a deposit?

For a deposit to be credited on the same day, it must be deposited before 3:00 p.m. (CST) on a business day. Deposits after 3:00 p.m. (CST), on a weekend or federally observed holiday, will be deposited the next business day.

When will my deposit post to my account?

Deposits made prior to 3:00 p.m. (CST) Monday through Friday most often will be posted by 9:00 p.m. when nightly processing has occurred. Deposits made on holidays and weekends will be posted by 9:00 p.m. the next business day.

Will my deposit amount be available right away?

The first $300 deposited per day is available immediately after it is posted to the account. Funds deposited greater than $300, have a two-day business hold. Amounts over $5,000 will be held for five business days.

Can I photograph more than one check at a time?

Only one check can be photographed per deposit.

Should I destroy my check after I photograph the deposit?

No. Once the deposit has been approved by DuTrac, mark on the face of the check “electronically deposited on MM/DD/YYYY” and keep the check for at least five business days to ensure it posts to your account. After five business days, securely destroy the check. Do not void the check after submittal in the event the deposit is not approved and needs to be re-submitted.

What if I submit a deposit for the wrong amount? Do I need to re-submit the deposit?

Yes, if you enter the wrong amount the deposit will fail, and you will need to do a new deposit with the correct amount.

What if I submit the same deposit twice in error?

If the same deposit is submitted twice, we will identify it and stop the transaction. You will receive a declined deposit notification for the second deposit received through the Mobile Deposit.

A check I submitted was returned, can I resubmit it?

No. If a check is returned, you may not re-deposit the check through Mobile Deposit. Please visit one of our branch locations to deposit your check.

Why are my check images blurry?

Taking high-quality photos of a check is the best way to make Mobile Deposit quick and easy. Below are hints to keep in mind:

- Use good lighting

- Place check on a dark background with only the check visible and no other objects or edges visible

- Make sure the entire check is inside the photograph frame

- Holding your phone too close to the check can result in a blurry image

How do I enroll in and use Apple Pay™?

To enroll in Apple Pay:

- To add your DuTrac debit or credit card, you will need an iPhone 6 or later with iOS 8.1 or later.

- Open the Wallet or Passbook® app, swipe or scroll down and tap the plus sign.

- Use your iSight® camera to enter the card, or add it manually (Note: Apple Pay’s photo-detection only works with embossed numbers; if you have a credit card with flat numbers, you have to enter it manually.)

- Manually enter the three-digit security code.

- At this point, card holders may need to wait for DuTrac to authorize the card.

- Accept the terms and conditions to complete the process.

To use Apple Pay in stores:

- Look for the contactless payment icon at the register.

- Hold your device near the reader and authenticate as prompted.

- Wait for the subtle vibration and beep-signifying payment has been accepted.

How do I enroll in and use Android Pay™?

To enroll in Android Pay:

- To add your DuTrac debit or credit card, you will need an Android OS 4.4 or newer.

- Open the Android Pay app (most Android phones come preloaded with this, but the app can also be downloaded from Google Play.)

- At the bottom right, tap +.

- Tap Add a credit or debit card.

- Use the camera to capture your card info or manually enter it.

- If you’re asked to verify your card, choose a verification method from the list.

- Find and enter the verification code.

To use Android Pay in stores:

- Look for the contactless payment icon at the register.

- Hold your device near the reader.

- If prompted, choose Credit regardless of the type of card. (You may have to enter your PIN. Use the PIN you set up when you activated your DuTrac debit card.)

How do I enroll in and use Samsung Pay?

To enroll in Samsung Pay:

- To add your DuTrac debit or credit card, you will need a Galaxy S6, Galaxy S6 edge, Galaxy S6 edge+, Galaxy S6 active, or Galaxy Note5.

- Open the Samsung Pay app and activate (most Samsung phones come preloaded with this, but the app can also be downloaded from Google Play.)

- Secure your account using your fingerprint or iris and enter a PIN, so you can authenticate for future purchases.

- Add your cards. Use the camera to capture your card.

Using Samsung Pay in stores:

- Look for the contactless payment icon at the register.

- You can open Samsung Pay from the Home screen, Apps menu,or Lock screen.

- Swipe or scroll up from the bottom of the screen.

- Swipe to the desired card.

- Verify your identity by placing your finger on the Home button. To use your Samsung Pay PIN, touch PIN. Then enter your four-digit PIN.

- Place the back of your device to the reader.

- You may have to enter your card’s PIN. Use the PIN you set up when you activated your DuTrac debit or credit card.

Android, Android Pay, and the Android Logo are trademarks of Google Inc.

Do you provide safe deposit boxes?

Safe deposit boxes are available at our Asbury, St. Mary’s, Holliday Drive, Maquoketa, Kimberly Road, Clinton and Bettendorf offices. We encourage members to use a safe deposit box to keep your valuable possessions secure. These protective boxes are located in a fireproof vault and require a DuTrac staff member to accompany you with a master key to gain access. The annual rental of each box varies by size and not all sizes are available at all locations. See safe deposit box sizes and prices.

What are safekeeping boxes?

Safekeeping boxes are self-serve and only require one key to access. These boxes are located in a secure fireproof vault and do not require a DuTrac staff member to accompany you. The annual rental of each box varies by size. Safekeeping boxes are only available at our Jersey Ridge and Eldridge offices. See safe deposit box sizes and prices.

Can I send a wire transfer from DuTrac?

Wire transfers are a way to electronically transfer money from or to an account at DuTrac or another financial institution. Popmoney is another option to send or receive money safely and quickly.

To have funds transferred to your DuTrac Community Credit Union Account the initiating company will require the following information:

- To: DuTrac Community Credit Union

- ABA/ routing number: 273974549

- Final Credit: Your name and account number (Please specify Savings, Checking, etc.)

For sending wires from your DuTrac Community Credit Union account, wire transfers cannot be guaranteed to be completed the same day if it is sent after 3 p.m CST. Wires are only done Monday through Friday, excluding federal holidays.